Relief by separation of liability may end up being the next best option if you don’t qualify for innocent spouse relief. Though this may not clear you completely of the tax debt the IRS has assessed, it could at least save you from owing a substantial amount.

WHAT IS RELIEF BY SEPARATION OF LIABILITY?

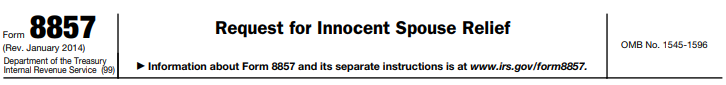

Relief by separation of liability under Internal Revenue Code (“IRC”) § 6015 (a) is the request by the taxpayer to have the assessment the IRS has made, due to the under-reporting of income, overstatement of deductions, or improper claiming of credits, allocated between themselves and their ex-spouse. What this means is that the responsibility to pay the back taxes is separated and then allocated to the taxpayer and their ex-spouse based upon each of their assets, incomes, and deductions. This type of relief is especially useful when splitting tax debt after divorce or legal separation and is filed on IRS Form 8857.

Relief by separation of liability can be especially helpful if you earned significantly less than your spouse.

EXAMPLE OF RELIEF BY SEPARATION OF LIABILITY

You and your spouse file married filing jointly. On the return you show income of $60,000. Your spouse shows $40,000 of self-employment income. After the return is filed, the IRS audits the return and shows you and your spouse did not report $30,000 of self-employment income, which results in a balance due of $10,000. You file and obtain a legal separation from your spouse and wait until you have not been members of the same household for 12 months. Then, you file Form 8857, Request for Innocent Spouse Relief. At the time you signed and filed the return you were aware of $15,000 of the $30,000 of income that was under-reported. If the IRS accepts the request, your spouse would be liable for the entire $10,000 tax liability and you would only be liable for the amount of tax attributable to the $15,000 of under-reported income that you knew about.

For additional examples see Treasury Regulation (“Treas. Reg.”) § 1.6015-3 (c)(4).

QUALIFICATIONS FOR RELIEF BY SEPARATION OF LIABILITY

After you have determined that you have incurred a joint liability due to the under-reporting of income, the overstatement of deductions, or improper claiming of credits by your ex-spouse, the process of separation of liability begins with the submission of Form 8857 – Request for Innocent Spouse Relief.

Let’s take a look at some of the qualifications under Treas. Reg. § 1.6015-3 (a):

1) You must have filed a joint tax return with your spouse.

2) You must file the request for relief no later than two years after the first collection was taken against you by the IRS.

3) There must be a liability at the time you request the relief.

4) You must be divorced or legally separated and must not have been a member of the same household for 12 months before filing for separation of liability.

5) You must have had no knowledge of the income that was under-reported, the deductions that were overstated, or the credits that were improperly claimed at the time the return was filed.

In certain cases the requesting spouse may still be eligible to pursue innocent spouse relief if the requesting spouse knew of the issue. In order to still be eligible, the requesting spouse must have been unaware of exactly how large of an income amount was being under-reported or exactly how much in deductions/credits were being overstated.

REASONS FOR DENIAL OF RELIEF BY SEPARATION OF LIABILITY

In addition to the qualifications, there are a few reasons why the IRS will deny your request.

1) The IRS proves that you and your spouse transferred assets to a third party as part of a fraudulent scheme.

2) The IRS proves that you had knowledge of the full amount of the income that was under-reported, the deductions that were overstated, or credits that were improperly claimed on the jointly filed return.

3) The IRS proves that the spouse transferred property to you in order to avoid tax or the payment of tax. This will not be presumed if the transfer of property was made under the stipulations of a divorce decree or separate maintenance agreement.

WHAT TO DO IF I DON’T QUALIFY FOR SEPARATION OF LIABILITY?

Not to worry, there are other types of relief even if your situation doesn’t meet the qualifications above.

Similar relief options and related areas include: