There are only two things certain in life, death and taxes. Though most people have probably heard this several times before, there is still a great misunderstanding of how our tax brackets work. So, it seems only fitting to clear up any misconceptions about one of the two certainties in life.

Most people have probably heard, at one point or another, someone state that they have been bumped into a higher tax bracket and now they will actually lose money. This statement is 100% inaccurate. Though the bonus or raise received may have affected their marginal tax rate (the tax rate on the last dollar of earned income) their average tax rate (the total tax paid as a percentage of total income earned) may have only been slightly affected.

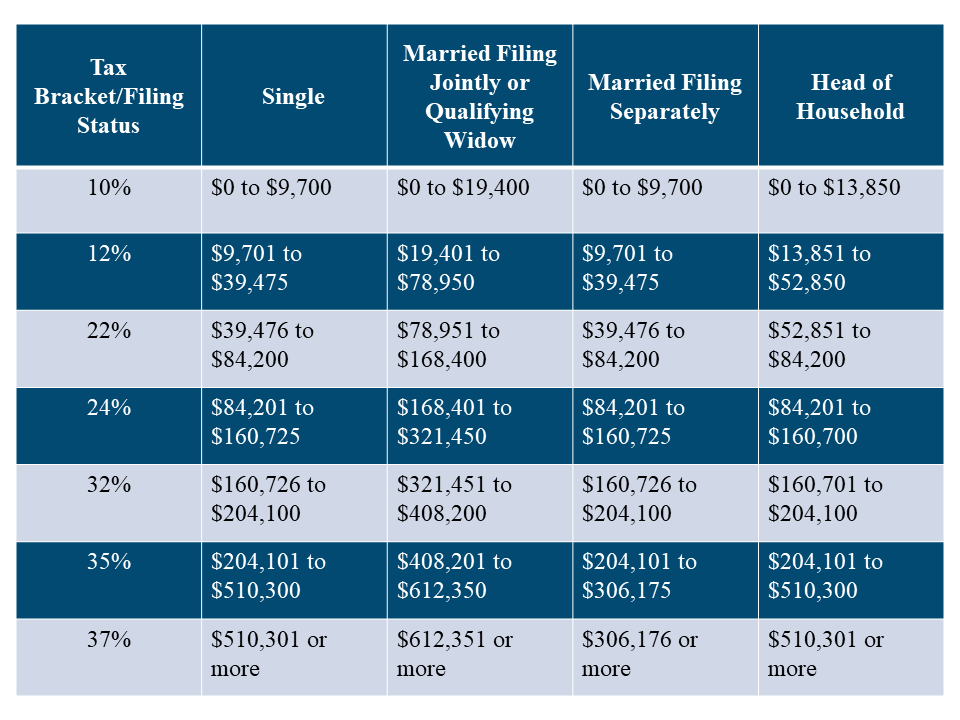

This misconception, more often than not, comes from a lack of understanding exactly how tax brackets work. So, let’s first take a look at what the tax brackets look like in 2019.

As the chart indicates, the amount a taxpayer’s income is taxed depends upon not only the amount of income a taxpayer makes but also how that taxpayer will be filing at the end of the year. Let’s do a side by side comparison of two individuals to see exactly how this works.

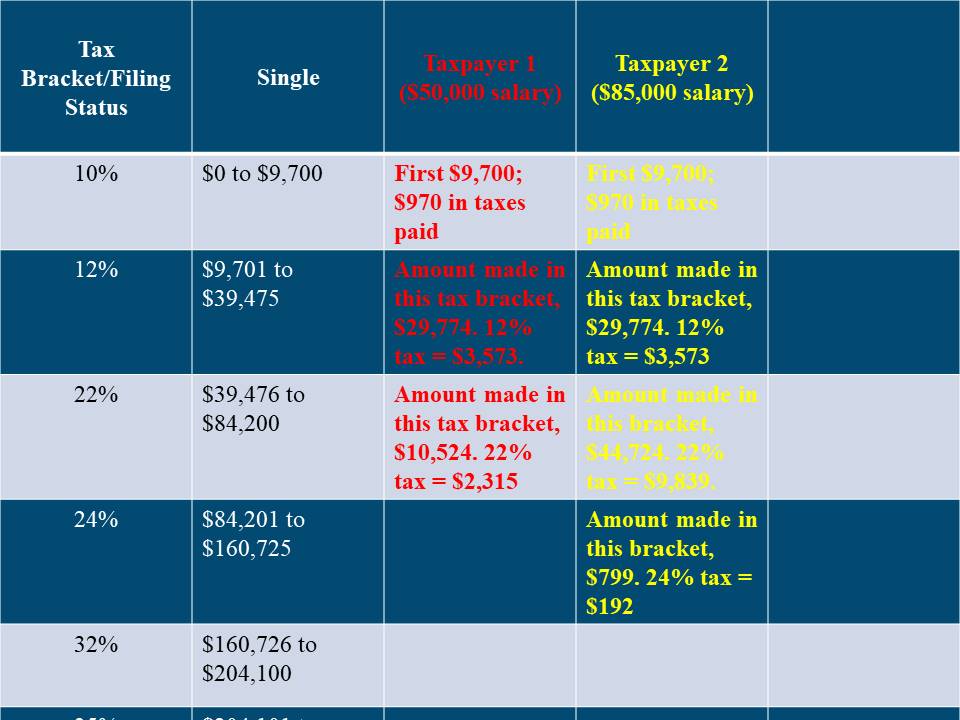

- Taxpayer 1 is single and has an annual salary of $50,000.

- Taxpayer 2 is single and has an annual salary of $85,000.

Notice that both taxpayers are actually paying the same amount in tax through the first two brackets. It’s only in bracket three where this changes because Taxpayer 1’s income stops at this bracket while Taxpayer 2’s income continues into the next bracket. Let’s break this down even further.

- Taxpayer 1’s marginal tax rate is 22% because this is the last tax bracket that was reached but, the average tax rate for Taxpayer 1 is 13.7% (total tax paid/total income).

- Taxpayer 2’s marginal tax rate is 24% because this is the last bracket reached but, the average tax rate for Taxpayer 2 is 17.1% (total tax paid/total income).

This comparison shows that the total amount in taxes paid is not determined by the last tax bracket you hit but by the progression through each tax bracket. It may help to think of it in terms of each tax bracket representing a bucket of water. You fill the first bucket of water (tax bracket) with money. This water bucket requires a certain amount of tax be withheld from the money that fills it but, it can only hold so much money.

If you make enough money to fill the first water bucket, whatever doesn’t fit begins to fill the next water bucket and so on and so forth until you can no longer fill the next bucket. Each bucket has it’s own tax rate associated with it and only applies to the money that has been put into it, meaning that even though you may have been able to put $1 into the 22% tax rate bucket that does not mean all the money filling the previous water buckets are taxed at 22% due to the previous bucket having it’s own tax rate associated with the money that is inside it.