Payroll taxes are something that any business owner should be familiar with if they have employees to whom they pay an hourly wage or salary. Having a good understanding of what payroll taxes consist of and how to properly withhold and pay the payroll taxes will help you in avoiding tax issues, not only for your business but for any person responsible for making sure they are paid. Should a payroll tax issue arise, the responsible person(s) could end up being personally assessed what are know as trust fund recovery penalties (“TFRPs”).

WHAT ARE PAYROLL TAXES?

In order to understand how and why TFRPs are assessed, it is first important to have an understanding of what payroll taxes consist of. Payroll taxes are owed by the business based on wages paid to employees and consist of two general components.

- The business/employer’s share

- Money withheld by the business/employer for the employee

Payroll taxes also consist of the portion withheld from the employee’s pay for their share of the payroll taxes, which is held in trust by the business and then remitted to the IRS or state.

Now, let’s take a look at what is considered actual taxes paid by the business for having employees and what is considered the employee’s share.

Taxes The Business Is Responsible For Paying

- Social Security and Medicare Tax (FICA) for each employee (employer’s half)

- Unemployment Tax (FUTA)

- Payroll Taxes That Are State Specific

- Some states may have additional payroll taxes that they impose on a business for having employees. Typically, these are for unemployment insurance.

Taxes Held In Trust By The Business For The Employee

- Social Security and Medicare Tax (FICA) (employee’s half)

- This is the employee’s share of FICA tax that they are responsible for paying and is automatically withheld by the employer.

- Federal Income Tax

- State/Local Income Tax and Benefits

WHAT ARE TRUST FUND RECOVERY PENALTIES?

TFRPs are what will be assessed personally to anyone in the business that is deemed by the IRS to be responsible for handling payroll or overseeing payroll when the FICA taxes withheld from an employee’s pay are not paid to the IRS. Under Internal Revenue Code (“IRC) § 6671(b) a responsible person is defined as “an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty” to pay over taxes withheld from an employee’s pay.

Example:

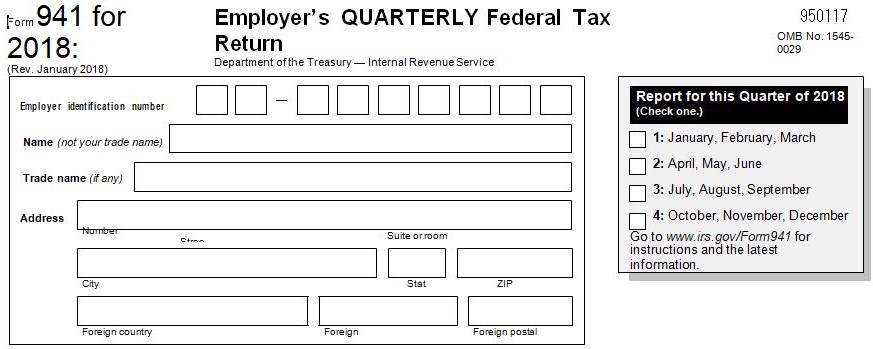

Company A has one employee who is paid a salary. Out of each paycheck, Company A withholds the amount of FICA tax the employee is responsible for. When filing the quarterly 941 payroll tax return, Company A does not pay over to the IRS the FICA tax that was withheld from the employee’s salary. Time passes and the IRS discovers that Company A did not make the payment of the FICA tax that it was holding in trust. The IRS then personally assesses TFRPs to each person the IRS deems responsible for the withholding and paying of this money.

The TFRPs will consist of the total amount of unpaid trust fund taxes (employee’s portion of FICA and federal income tax withheld by the business/employer).

WHO IS RESPONSIBLE?

A responsible person can be anyone the IRS determines had the duty of withholding and paying payroll taxes. Though the circumstances of each case differ there are some factors that the IRS typically will consider when determining who is a responsible person.

- Corporate status

- The individual’s duties

- The individual’s ability to hire and fire employees

- The signature authority of the individual over the business accounts

- The individual’s ability to “control” the payment of other creditors before the IRS

Control

Control is a big part in determining who is actually a responsible person. For instance a person who has the ability to sign checks but does not actually have control over determining who the checks are being paid to typically would not be considered a responsible person. On the other hand someone who delegates the task of paying the payroll taxes to someone else does not exclude themselves from being a responsible person.

Willfulness

After the IRS has determined who is a responsible person and whether or not they had control over how the business funds were to be used, the IRS will then determine if that person willfully failed to remit the payroll taxes to the IRS. This determines whether or not the individual chose to pay another creditor before the IRS or perhaps just decided to not pay the IRS at all.

It can be difficult to prove that a responsible person did not willfully decide to pay other creditors before the IRS. Also, in the eyes of the IRS the responsible person should have been aware of the tax issue even if they weren’t the one directly deciding to pay other creditors first.

In instances where someone is ordered by their supervisor to pay a creditor ahead of the IRS, that person has been deemed a willful participant. The IRS will argue that the person should have risked being fired over complying with something the individual knew was wrong.

Note: Should someone become a responsible person after TFRPs have been assessed, the responsible person would not be assessed the TFRPs. However, if the responsible person acquires this status after TFRPs have been assessed and uses funds the business still has in it’s possession that were in fact withheld from employee earnings to pay other creditors before the IRS, they then can be assessed the TFRPs.

TFRP ASSESSMENT PROCESS

The assessment of trust fund recovery penalties will begin with an investigation by an IRS Revenue Officer to uncover all potentially responsible persons. They will request corporate documents, bank records, and other related documentation necessary to make their determination. If the Revenue Office is unable to get the information from the parties voluntarily, a summons will generally be issued.

Next, the Revenue Officer will start the interview process of all individuals believed to be a responsible person. During the interview the Revenue Officer will ask detailed questions about the operations of the business, including other employees and their duties. In short, the Revenue Officer is looking for people to give up information on their co-workers and supervisors.

The interview process is very important because the form used by the Revenue Officer does not allow for detailed explanation. Instead, the questions being asked will mostly be in a “yes” and “no” format, though you are able to secure statements from other employees to submit with your interview answers to help your case.

Note: The individuals who the Revenue Officer potentially holds responsible may also be requested to fill out form 433-A Collection of Information Statement. This form is used to determine the potential ability to collect from each individual. If the Revenue Officer determines that the ability to collect the TFRPs from an individual is low or unlikely due to lack of assets or income, the likelihood of TFRPs being assessed to the individual is low.

COLLECTION OF THE TFRPs

Once identified by the Revenue Officer, the responsible person(s) will be personally assessed the trust fund recovery penalties and the IRS will issue a notice with a due date for payment of the TFRPs.

- Each responsible individual has the right to appeal the assessment of the TFRPs within 60 days of receiving the notice.

- The IRS has the ability to assess TFRPs within three years from the April 15th date succeeding the due date of the quarterly 941 payroll tax return, if the return was timely filed, or three years from the date the return was actually filed.

- 941 returns that were never filed, fraudulently filed, or prepared by the IRS do not have a three year statute of limitations.

Each person that is assessed the TFRPs is fully responsible for the entire amount. However, if you are able to determine who else was assessed, it is advisable to speak with them about contributing to the payment of the TFRPs.

Note: TFRPs are somewhat of a misnomer because it isn’t the assessment of an additional amount owed. Instead, it creates joint and several liability between the business and all other individuals assessed the TFRP for the trust fund portion of the taxes owed.

Example:

If X, Y, and Z are held responsible for the TFRP and X pays the entire trust fund liability off…the IRS cannot collect from Y and Z. You can also think of this like a married couple filing a joint return. If Wife pays off the balance owed, Husband is off the hook (as far as the IRS is concerned). In the example above, X might have a civil action for contribution against Y and Z for their respective portion of the trust fund taxes.

CONCLUSION

If your business is new and you are hiring employees, make sure to educate yourself on how payroll taxes work. Having a trusted payroll company handle the payroll for you can greatly reduce the risk of a payroll tax issue arising.

If you already have a business with employees, make sure you stay on top of paying the payroll taxes. Should you already be aware of an issue, you may be able to take corrective actions before it gets to the point of TFRPs.

Hiring legal representation to navigate this process is always advisable as there are several steps involved. Not only can it be difficult to navigate but, the timing of each step varies on a case by case basis and can take anywhere from a couple months to over a year to be completed. Legal representation can also limit your exposure to the IRS and potentially minimize the amount of liability that will be assessed. Especially if you do not believe you are a responsible person.